2021 electric car tax credit california

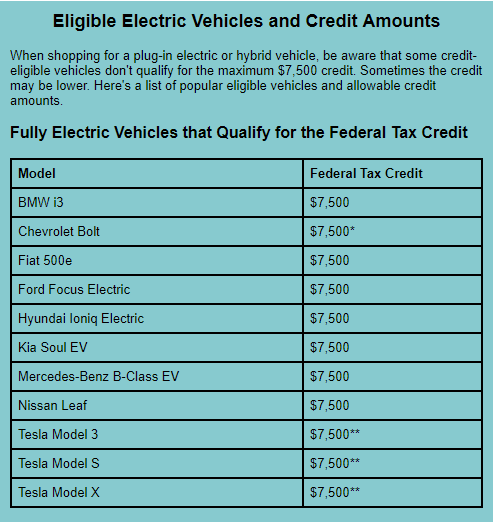

Well stick with vehicles that get the full credit below but the EPA has a full list that includes the lesser credits. Local and Utility Incentives.

Ev Incentives Ev Savings Calculator Pg E

Electric Cars Eligible for the Full 7500 Tax Credit.

. The tax credits are up to 7500. The maximum amount that their tax credit can be is 5000. Sales or use tax is due on the total selling price of the vehicle.

Grand Cherokee 4xe coming winter 2022. But if someone owes more than 7500 in taxes then they cannot claim a higher tax credit than 7500. The state of California has their own cash rebate program for its residents who.

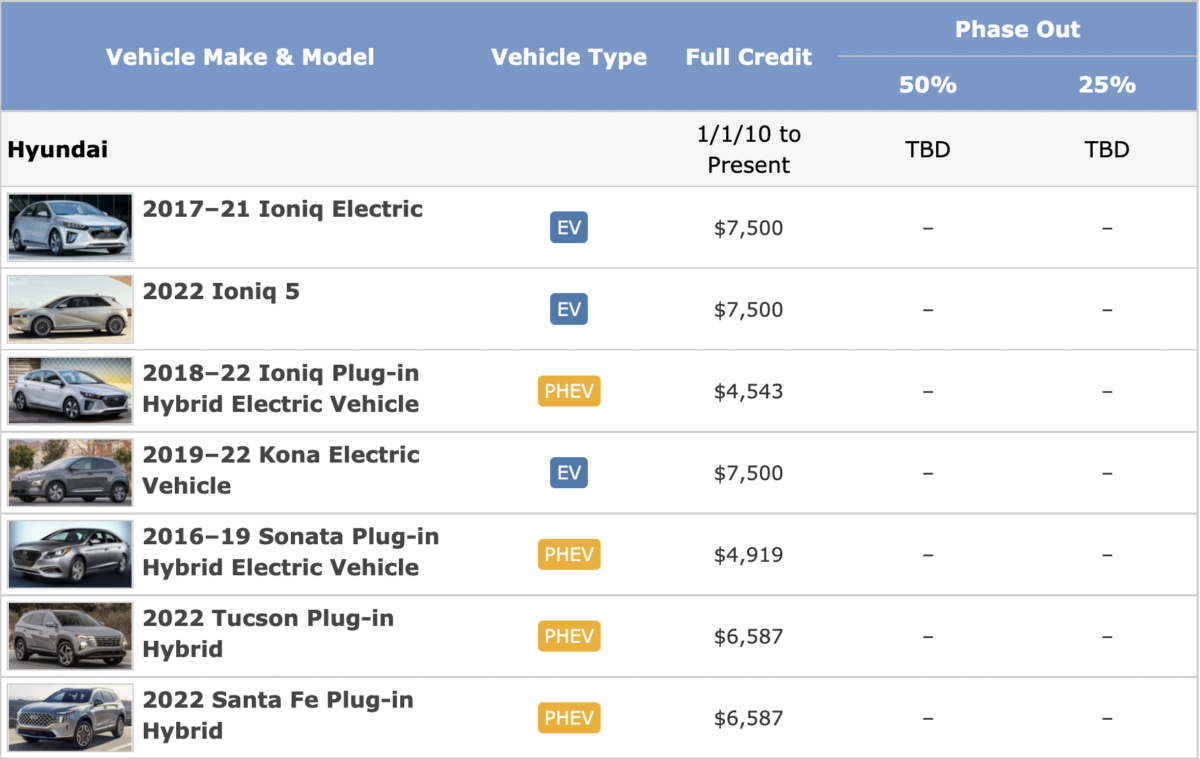

Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Which Ford Electric Vehicles Are Eligible for Federal Tax Credits. Federal tax credits are available for the purchase of all-electric and plug-in hybrid vehicles.

Many Ford electric vehicles are currently eligible for both state and federal tax rebates. Small neighborhood electric vehicles do not qualify for this credit but they may. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

Electric Vehicles Solar and Energy Storage. Now thats a bang for your buck. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. These federal tax credits do not reduce the selling price of the vehicle or reduce the sales or use tax that is due.

To learn more about which electric Ford SUVs and trucks qualify please refer to the charts below for eligible 2021 and 2022 Ford models. 27 rows The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Not bad considering all the price increases applied by Tesla over the course of 2021 as well as the lack of the 7500 federal tax credit. 5 Symptoms of a Bad Front and Rear Wheel Bearings. We will update this page once this measure has been made legal.

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity. State andor local incentives may also apply. The credit amount will vary based on the capacity of the battery used to power the vehicle.

First decide on the car you want and find out if the automaker has EV tax credits available for buyers. Does the EV Tax Credit Apply to Used Cars. If you purchase or lease a Jeep Plug-in Hybrid Electric Vehicle PHEV you might be eligible for up to a 7500 federal tax credit with possible additional state incentives.

In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. Federal Tax Credit Up To 7500. You must fill out IRS Form 8936 when filing your annual income tax returns.

As noted above after the automaker has sold 200000 vehicles the credit is reduced to 50 percent of the original amount. Claiming your EV federal tax credit is a fairly straightforward process. That amount is the cutoff point.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. And April 7 2021. Tesla cars bought after December 31 2021 would be eligible for.

Additionally this would set an income limit for buyers to 100000. Keep in mind that not all online or software-based tax systems support this form. 2021 the internet.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

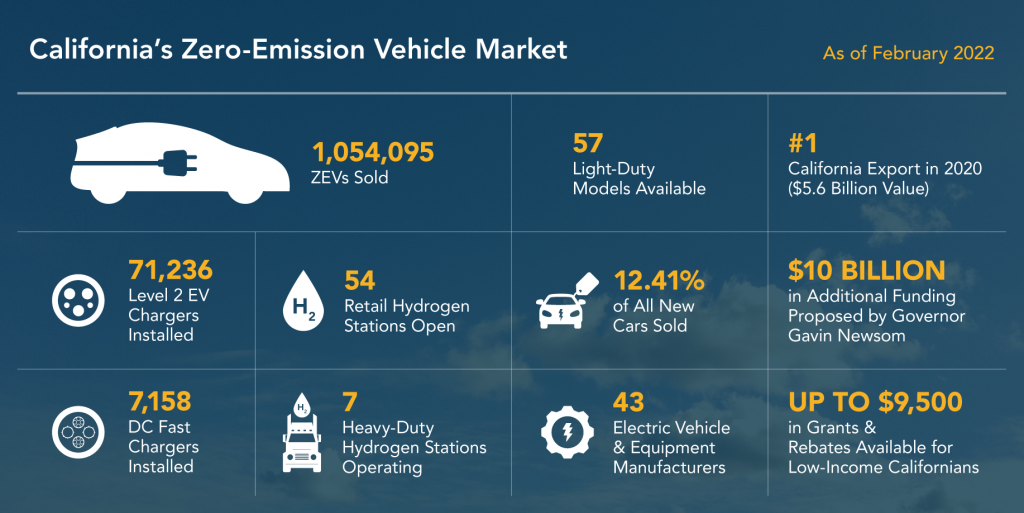

California Leads The Nation S Zev Market Surpassing 1 Million Electric Vehicles Sold California Governor

Ford Focus Electric Tax Credit Off 68

Electric Vehicle Stocks Tumble After Manchin Rejects Biden S Climate And Social Plan

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Do Electric Car Tax Credits Work Credit Karma

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

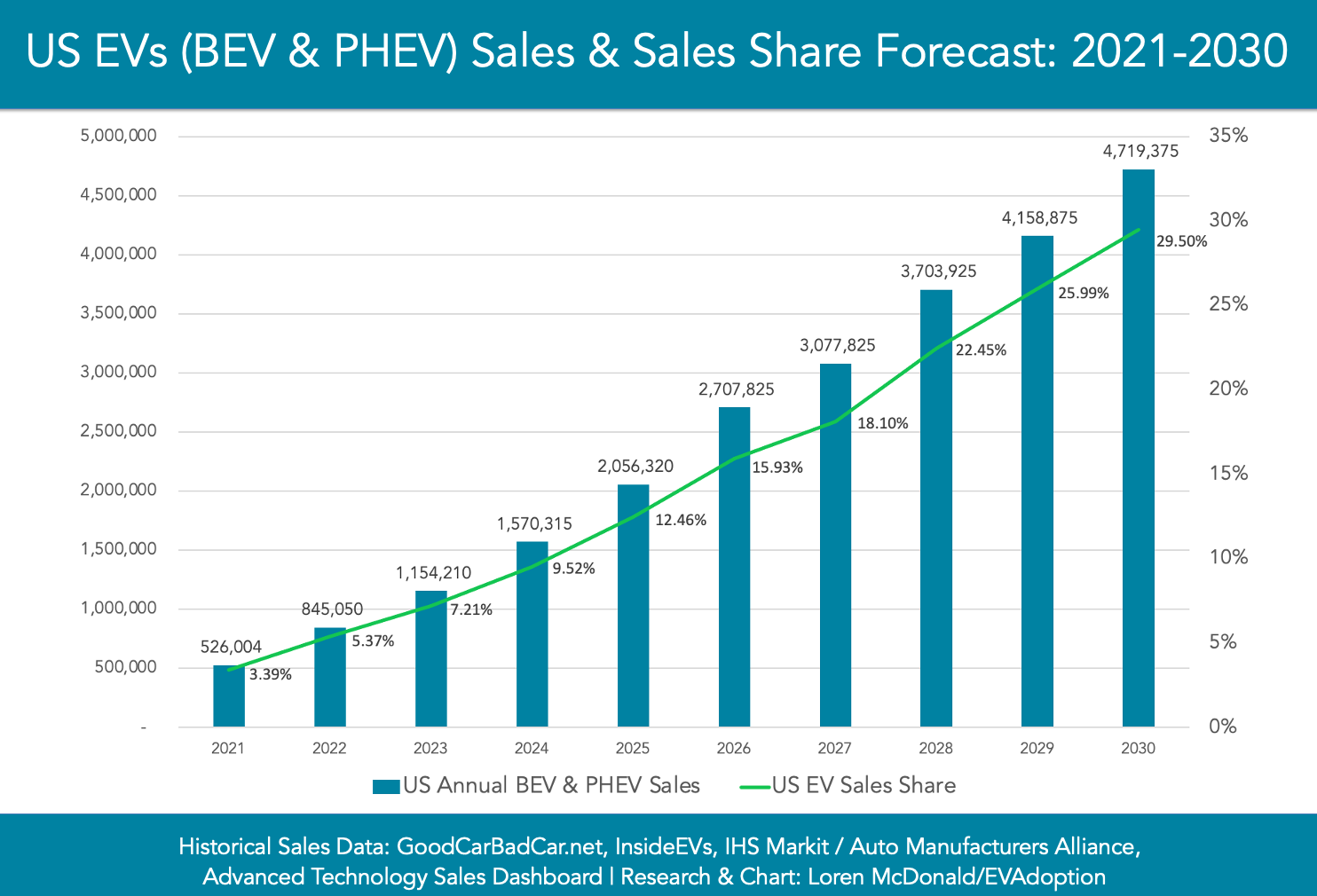

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Toyota Mirai 7 500 California Tax Credit Eligibility Toyota Of Hollywood

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Ford Focus Electric Tax Credit Off 68

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

California Ev Incentive Is Getting Smaller In November

Electric Vehicle Tax Credits What You Need To Know Edmunds

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek